Social media has been a touchy subject for most regulated industries, especially for financial services.

Yet, as digital transformation continues and social media becomes an even more powerful place to build a brand, now’s the time for the financial services industry to get on board with being social.

Typically, financial services ignores social media (except for the basic corporate handles) because:

- There are concerns about accidentally sharing confidential info

- Afraid of employees posting something that makes the company look bad

- A mindset that social media is for marketers only

- A belief that only licensed employees can be active on social

- The potential for digital blunders that would negatively affect the organization

But by not being social, financial service companies fall behind and miss HUGE opportunities to connect with their customers, attract target buyers, increase talent attraction, shorten sales cycles, and much more.

Below, we’ll cover employee advocacy for financial services and how your company can benefit from a social program without harming your brand trust as a regulated industry.

How Social Media Helps Financial Services

People turn to social media to learn about financial products and services, but they often encounter little more than corporate social accounts delivering branded messaging and not much else.

By having only corporate social accounts talking about the company and its products, a financial service organization misses out on thousands of new people discovering the brand and seeking out its company content.

And quite frankly, content shared by corporate handles simply isn’t trusted as much compared with content shared by individuals themselves, such as those same corporations’ employees.

That’s why financial service companies should allow employees to be social — and tweet, post, and share — on behalf of the company.

Does it sound scary letting employees be social?

Edelman Trust Barometer research shows that financial services is the least-trusted sector among the general population. Yikes!

But there’s a positive finding with this research too: 80% of financial services employees trust their company to do the right thing.

This is encouraging because employees of financial service companies already have positive views of their employers and view them as trustworthy.

And these two things are key for the financial industry to be successful in an “employee-focused” social media strategy.

So how can social media help financial services?

- Help increased inbound opportunities

- Build brand loyalty and trust

- Help grow brand visibility and reach

- Attract highly skilled job candidates

- Humanize the brand further

- Show that the company isn’t digitally outdated

- Lower customer acquisition costs

Financial Service Companies’ Advocacy Mistakes

Before I get into the types of content and how you can set up a successful employee advocacy program as a financial service company, we should talk about content first.

Why? Because content is key to your program’s success if employees actually share it organically on your company’s behalf.

Despite this, financial service companies often make the following mistakes when it comes to content.

Mistake #1: Content is shared only by employees with specific licenses.

One of the big misconceptions our team at EveryoneSocial hears often from financial service brands is that content should be shared only by employees with specific financial certifications or licenses.

There are quite a few regulations out there and it’s understandable to be cautious when it comes to sharing content that’s more direct investing advice, for example. I totally get it — you don’t want to violate FINRA, SEC, FTC, or any other rules or regulations that apply to what your organization does.

Although there is some valid truth to that aspect, that’s only one type of content your company should be sharing to drive results. And by limiting employees in your social program, there’s a massive missed opportunity to reach and impact your audience.

Mistake #2: Only company news articles are shared.

In any healthy employee advocacy program, you want to share articles that link back to your company website or brand channels. However, you don’t want to limit yourself to sharing only company news and updates alone.

Consumers expect content to be engaging and provide value to them. And your employees won’t want to spam their networks with content that fails to do this.

Additionally, social media algorithms change frequently and over-posting link-only content can start to bury that content in feeds and generate less engagement.

The financial service companies that understand the value of being open to creativity and being more educational with their content for employees to share will see much better results.

The companies that refuse to adapt or test new types of content, are the ones that’ll get left behind in the digital dust.

Mistake #3: Wanting to (or currently do) posting to employees’ accounts

Full stop.

Employee advocacy programs are not about the company posting on employees’ behalf.

We’ve had a few inquires over the years where companies are doing this or want to have that control, especially in regulated industries.

This is a BIG mistake for numerous reasons.

99.9% of the time the content that company posts for employees is generic and incredibly unauthentic.

This is a sign the company thinks this is a shortcut to results and instead, leverages their employees’ networks as just an additional place to spam. The lack of results from this “strategy” will speak for itself.

Additionally, not many employees are going to be okay with a company controlling their personal social handles — nor should they be.

And that also technically goes against terms of services of social networks, so it’s basically, a good way to get your social media API use revoked.

Naturally, you will want to have some protection in place as employees share on the company behalf, but we’ll get into that below.

Content for Financial Services

As mentioned in the previous section, one mistake we often see with financial services is everything they post is about the company is a link back to the branded website. Your social program definitely needs to include that, but it should be a healthy mix of different types of content.

So add variety to your social program! Content variations get employees more interested in sharing consistently, and audiences will connect and engage more frequently if you share a mix of different things.

Also, keep in mind that social algorithms change frequently and constantly chasing the latest trend of what content type works isn’t worth it. Good content and various types will always win with audiences.

Content types for sharing:

- Blog posts/case studies/guides/PR/Podcasts

- Third-party relevant content

- Image/Gif posts (with no links)

- Text-only posts (educational, conversational, can take parts of blog posts)

- Video content (Native, video links, public post pages in EveryoneSocial)

- User-Generated Content (Content added by employees or suggested by them)

Ensure there’s good context to the social copy you post. And allow employees to add their own voice to the posts they share where you can (even with templated content that might be added, allow the edit option).

For successful advocacy programs we’ve seen, generally, 60%+ of the content is not specific to the brand or website links. Even when not every post is about the company, these still impact the brand.

Financial services content examples

If you recall from the previous sections, I mentioned that content doesn’t need to be specific advice that only licensed employees can share.

You can certainly have that type of content and easily post it in a private group in EveryoneSocial for only authorized employees to share though. (More on that later).

Financial services need to be open to being more creative and educational with their content though. And they need it to create value so that participants in your employee advocacy program will want to share it.

You may have different interests when it comes to an employee advocacy strategy like for marketing and sales, employer brand and recruiting, communications and employee engagement — or maybe you want to scale company-wide. But no matter what, there are plenty of content feeds you can set up for employees to share.

Some content examples:

- About your brand (type of place to work, work culture, employee highlights)

- Your company’s financial services/products or news

- Educational content about investing, finances, financial industry, insurance, etc. (This does not need to be specific investment advice, but more generalized info) Ex. 10 Reasons to Save For Retirement (Could just be a blog post, image or GIF, or a text post where you share a snippet of value from a blog post)

- Understand what the different teams that will be in your advocacy program are interested in/and their expertise as an individual. For the marketers getting involved, maybe content about marketing could be added for sharing.

- Add trusted third-party sources of varying topics to share. Not everything has to be related to be brand specific or the financial industry. Add RSS feeds of selected mediums for employees to see and share if it interests them

Remember: Posting links all the time just about your company’s products/services does more harm than good. Networks engage less, your content doesn’t appear in users’ feeds as much, and it looks like spam. Audiences expect more from content, as do employees.

But wait, how does this all generate results?

Even if your content is not directly brand-specific on every social share, people see employee headlines or bios of where they work or what they do. People will click employee profiles and see where they work that way, too.

Those impressions and engagements still impact brand awareness, sentiment, sales, hiring, and overall trust even if there’s not a directly measurable impact like with dark social.

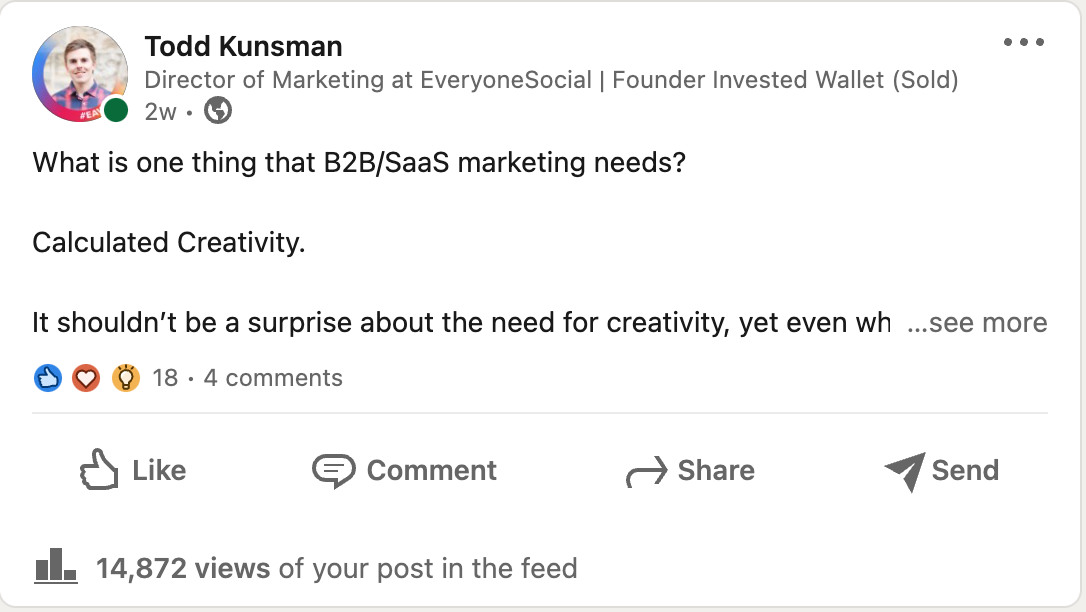

Example: I’m in marketing, and the three pillars I post about from our employee advocacy instance (Yup, we use our own product) are:

- Marketing insights, learnings, industry, thoughts

- Employee advocacy insights, learnings, thoughts

- EveryoneSocial: hiring, work environment, news, etc.

One of my text post shares generated 14k+ views in the first six days and 200+ extra people viewed my profile in those few days, most of which were new people I wasn’t connected with. Additionally, a handful of people followed me from this one post.

The company I work for is clearly visible even if people didn’t click to see my profile, so while this post wasn’t about my work or EveryoneSocial directly, more people have seen the brand name and even looked into our company because of it. In other words, this post had an indirect influence on my company that went beyond my personal brand.

Now imagine if I made two to three posts like this per week for a month, a quarter, or a year. Think of the results that would generate not only for my personal brand, but also for the company brand. Then extrapolate that among the hundreds or thousands of employees in your advocacy program.

Keep this in mind:

- 79% of people say UGC/EGC highly impacts their purchasing decisions.

- According to ComScore, brand engagements rise by 28% when consumers are exposed to a mixture of professional marketing content and user-generated content.

- Almost half of customers (48%) claim that user-generated content and shares is a great method for them to discover new products.

Looking for some more interesting data? Read more about user-generated content statistics here.

Setting Up Your Program As A Financial Service Brand

Now that you have a bit of insight into mistakes to avoid and the content strategy, how do you set up your employee advocacy program as a financial service company?

Understandably, regulated industries need some checks and balances. That’s why EveryoneSocial has certain features that’ll be important for you to utilize.

Program goals and content strategy

Before you even begin your program, you’ll want to understand what your program goals are and what type of content strategy you’ll need.

Every program might be different and what you want to accomplish. We have customers using our platform for primarily marketing and sales, but then we have others where it’s all about employer branding and employee engagement.

If your goal is to go company-wide, your content strategy is going to be much more robust and you may want a few moderators to help manage it. You can also ask the EveryoneSocial team about our managed services option, which takes a lot of the set-up and program management off your plate.

And if your content or process for social is currently weak, you’ll want to create a plan with the right people to ensure that’s improved before going deep into employee advocacy.

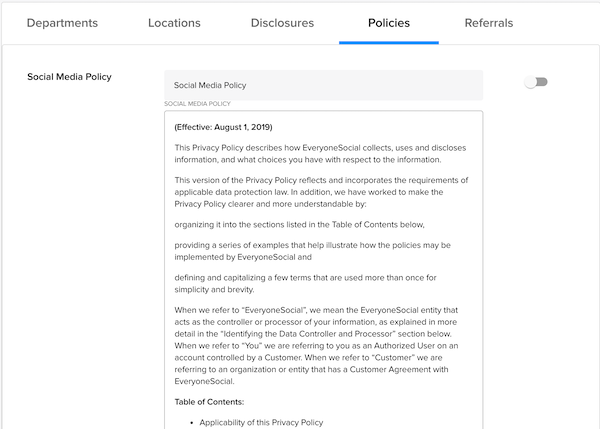

Strong and accessible social media policy

At this point, every company should have a clear and accessible social media policy for employees. Your company may have one that is outdated and if so, this is a great time to work on it with whoever owns that policy. It needs to be simple, but also allow anyone to understand your company position on social media at work.

If you use EveryoneSocial, you can add your social media policy to the platform so everyone can easily find it and read it.

Have social workshops on some cadence

While some generations have grown up with social media and are experienced with it, many employees may not fully know how to share or create content effectively.

One way to help employees learn and grow, while helping your company feel more comfortable with employees sharing content, is to host internal workshops. Some of our customers do this and have great success in engaging employees to join their employee advocacy program.

Have employees in other departments who don’t hold licenses go through simple social media training doesn’t have to be complicated. Plus, it can be incredibly impactful.

You could have the marketing team teach these, you could bring in an outside expert, or you could even ask our team at EveryoneSocial to help when you use our platform.

Start with executives (or get them more involved)

We’ve always told our customers that executive support is critical to long-term employee advocacy success and growth.

If your executives don’t see the value or understand how this strategy is powerful, it’s going to be challenging for your company to build a great social program.

- American Family Insurance has done very well with their employee advocacy program for years. It utilizes select employees (marketing, sales, and comms folks) and executives. Their CEO is very active on social media as well.

- Fidelity has executives create and share content consistently, which motivates other employees to get involved. They now have thousands of employees in their advocacy program.

- While not a financial service company, Indeed shares videos from the CEO in its employee advocacy program to discuss the value and why they use EveryoneSocial.

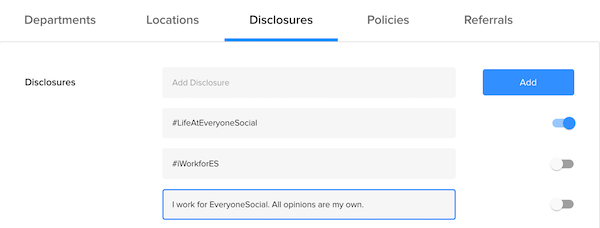

Use the disclosures function in EveryoneSocial

One way to add some compliance to employee shares is to use disclosures that are appended automatically to any shares from EveryoneSocial. Utilizing specific hashtags or phrases can add some reassurance to what’s distributed on employees’ personal social networks.

Personally, I recommend utilizing a hashtag as it takes up less social copy real estate and it’s something audiences can easily identify and click to learn more.

For example, American Family Insurance uses the hashtag #iWork4AmFam and Fidelity has a few, but a common one you’ll see from their employee shares is #FidelityAssociate.

You can easily add these in EveryoneSocial as an admin, and any disclosures cannot be removed when employees go to share content. Even if you allow them to craft their own social copy, the disclosure will still be added.

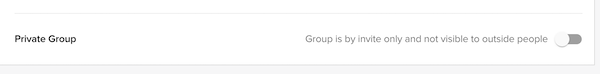

Creating Private Content Groups

While we know that anyone and everyone should be able to share content, there may be some content that you want accessible only to certain groups of employees. For example, those that hold specific licenses or certifications.

The easiest way to ensure this content is shared by those specific employees alone is to create private groups.

This is an EveryoneSocial feature where you can invite people to join a group where the content is specific for them to read or share. No one else in your employee advocacy platform can see or engage with this content unless they’re invited to the group.

We’ve seen customers use this for specific departments, executives, or other groups of employees with expertise.

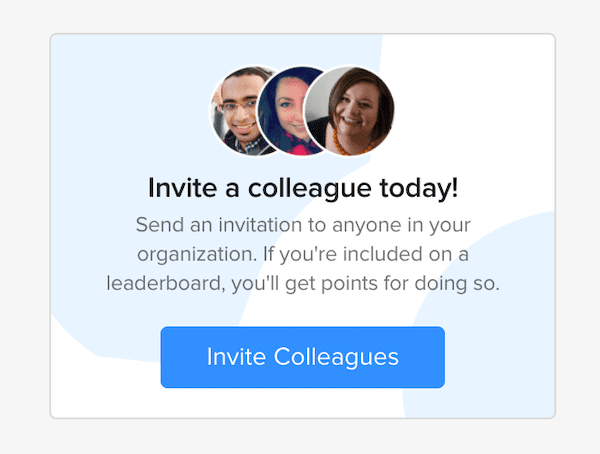

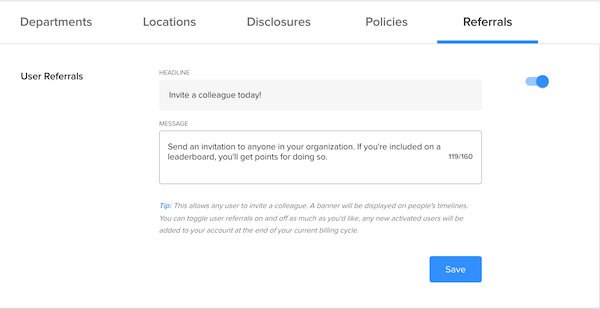

Enable colleague referrals

As more employees join your employee advocacy program, it scales results and fuels growth from social media.

But beyond inviting employees directly, you can also enable a referral option in EveryoneSocial that allows anyone to send an invite to a colleague. This can be more powerful when it comes from a close co-worker, instead of a program admin.

Why Should Financial Service Employees Be Active on Social Media?

When it comes to getting employees active on social media, there’s certainly a lot to consider.

I’ve talked a bit about how social media helps the financial industry and the type of content to post, but now it’s best to understand how to put it all in place.

Besides some of the information from above, encouraging employees of financial institutions to be active on social media may seem like a giant headache — or, at the very least, a lot of work.

But we’ll get into that a little bit later in the next section.

So why should employees be sharing on social media (and not just the marketing folks)?

- 76% of individuals say that they’re more likely to trust content shared by “normal” people than content shared by brands. (Adweek)

- 33% of buyers trust the brand while 90% of customers trust product or service recommendations from people they know (Nielsen Global Online Consumer Survey)

- 98% of employees use at least one social media site for personal use, of which 50% are already posting about their company (Weber Shandwick)

- Content shared by employees receives 8x more engagement than content shared by brand channels (Social Media Today)

When consumers need to understand something, they don’t turn to advertising for answers. They go to people they trust the most like their friends, colleagues, and family.

So back to how to manage employees being social and keeping it all organized. This is where an employee advocacy can platform help.

Remember, an employee advocacy program:

- Improves social organic reach

- Helps ensure compliance and consistency

- Keeps content organized

- Enables employees to be authentic

- Features numerous settings to encourage sharing

- Has data and reporting insights to help you continually improve your program